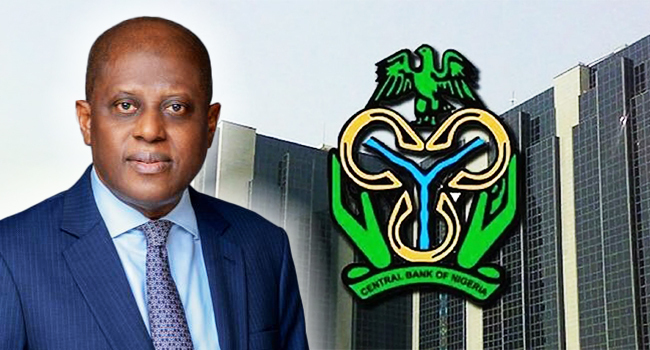

Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has said the country recorded a total foreign exchange inflow of about $24 Billion in the first quarter of 2024.

Cardoso made this disclosure during an interview with Bloomberg TV on Tuesday in London.

According to him, the inflow is about 50 per cent above the inflows recorded in previous quarters up to 2021.

The governor also declared that the days of excessive Naira volatility were over, highlighting the positive impact of the monetary policy tools employed by the apex bank to tackle the challenges facing the forex market.

He explained that the inflationary pressure has started dropping as a result of the bank’s policy measures, which aim to reduce the current inflation rate of 33.69 per cent.

He assured that the Monetary Policy Committee members remained vigilant in monitoring inflation trends and ensuring a moderation of inflation numbers. On the relative stability enjoyed in the exchange market, the former Lagos State commissioner for Finance said the bank was relatively pleased with the progress it has made in stabilising the Naira and would encourage measures to drive down the rates, adding that the worst was over for the Naira’s fluctuations.

Cardoso’s optimism stems from the CBN’s multi-pronged approach to stabilizing the naira before the recent interventions, speculation and manipulation in the Forest Exchange contract market, were contributing to naira volatility.

African investors accounted for 22.76% of Nigeria’s foreign capital inflows in Q3 2024.

The National Bureau of Statistics (NBS) has reported that African investors, excluding those from Nigeria, contributed 22.76% of the total...

Read more

Boss98.9 FM

Boss98.9 FM